tax act stimulus check error

We break down the major changes that could impact. Will elderly Social Security recipients receive a stimulus check.

Fourth Stimulus Check What S The Status Weareiowa Com

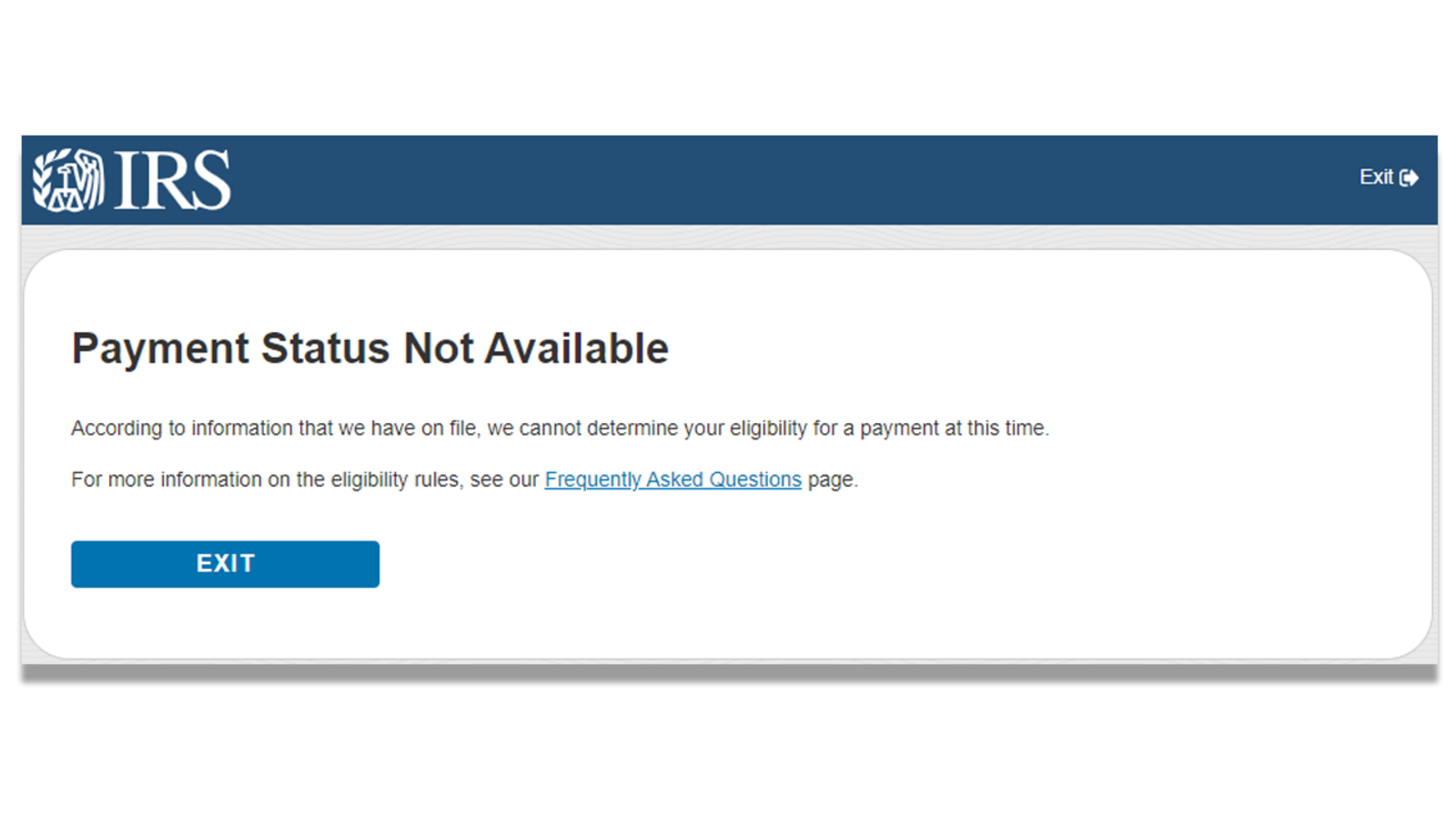

You can no longer use the Get My Payment application to check your payment status.

. You may be due 1200 1800 or 2400. Perfect for independent contractors and small businesses. The first payment of 1200 was sent in March 2020 followed by a check of 600 in December 2020.

What does the third stimulus check mean for US. This payment is different than the Golden State Stimulus I GSS I. Most eligible people already received their Economic Impact Payments.

Had a California Adjusted Gross Income CA AGI of 1 to 75000 for the 2020 tax year. IRS has an on-line tool Wheres My Tax Refund at wwwirsgov that will provide the status of a tax refund using the taxpayers SSN filing status and refund amount. Can I get the second stimulus through my 2020 tax return the one I file in 2021.

Under the CARES Act which was signed into law in mid-March eligible Americans were entitled to receive up to 1200 per individual and up to 2400 for married couples. If you didnt register and didnt receive a maximum 1200 payment from the first stimulus package you may be eligible to receive those funds through a tax credit by. The 1400 stimulus check for Social Security recipients Delany said would be a way to get more tax -free income into the hands of seniors.

Check E-file Status Service and. The IRS is not using the non-filers tool for third-round stimulus checks either. Assuming no issues IRS issues tax refunds in less than 21 calendar days after IRS receives the tax return.

The Economic Stimulus Act of 2008 PubL. Line 17 on Form 540. Monthly checks in fairly small amounts or one-time payments of up to 2000.

As a result if you dont file a 2019 or 2020 tax return youll have to claim any money youre owed as a Recovery Rebate credit on your 2021 return which you wont file until next year. Line 16 on. Do Not claim any missing first or second payments on your 2021 tax return.

If you filed your tax return between January 1 2021 and March 1 2021. However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021. However you can avoid having to wait until next year by filing a 2020 return before the May 17 2021 deadline.

For this information refer to. If you filed your tax return between March 2 2021 and April 23 2021. Families were eligible for an additional credit of up to 500 for each child under 17.

The second stimulus payments will be advance payments of the recovery rebate credit just like. But thanks to the Families First Coronavirus Response Act FFCRA and the Coronavirus Aid Relief and Economic Security CARES Act you might see some relief when you file your 2020 taxes taxes filed in 2021. Stay up-to-date with the latest information in stimulus check payments tax filing changes and tax breaks at our COVID-19 Hub.

The skys the limit if youve got three children and are married and havent gotten your payment. Estimate your tax refund using TaxActs free tax calculator. See how income withholdings deductions and credits impact your tax refund or balance due.

No your stimulus payment will not be reduced for these reasons. Allow up to 2 weeks. By using the transcript transaction codes cycle codes and descriptions you can get a lot of information that WMRIRS2Go or even an IRS agent does.

You will receive your stimulus payment beginning after April 15 2021. A fourth stimulus check from the government could take one of two forms. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms.

Check if you qualify for the Golden State Stimulus II. This content is for the second stimulus check. The 2020 tax return is the great corrector for all changes issues or lost money that you didnt receive with your stimulus check says Mark Steber senior vice president and chief tax officer at Jackson Hewitt.

Can my third stimulus payment be offset for past due federal taxes or child support. Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund. If your first stimulus check was short you may soon have money coming your way.

Save any letters received from the IRS about stimulus checks and present them when you work with an HR Block tax pro to file your 2020 tax return. 110185 text 122 Stat. House of Representatives on January.

The third stimulus check is part of the 2021 American Rescue Plan Act ARPA a Coronavirus government relief package designed to provide further economic assistance to Americans struggling with the economic impacts of COVID-19The relief package includes direct 1400 payments to each. 613 enacted February 13 2008 was an Act of Congress providing for several kinds of economic stimuli intended to boost the United States economy in 2008 and to avert a recession or ameliorate economic conditionsThe stimulus package was passed by the US. With the agencys delay in processing tax returns trying to register for a new direct deposit account with your 2020 tax return wont get you into the system quickly enough.

File a 2020 tax return if you have not filed one yet or amend your 2020 tax return if your 2020 return has already been processed. Many Americans are feeling the impact of the COVID-19 pandemic on their everyday lives. Self-Employment Tax Resources Tax Information TaxAct Features TaxAct Blog Stimulus Center Tax Extensions Support Business Taxes Professional Taxes 0.

Once available on your IRS accounts tax transcripts may actually be a great source of information around updates regarding your refund and potential processing delays beyond 21 days due to other payments for example. Allow up to 4 to 6 weeks for mailing. To qualify you must have.

Filed your 2020 taxes by October 15 2021. Stimulus questions and answers.

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Pros And Cons Of Stimulus Check Economic Impact Payment

![]()

1 400 Stimulus Check Tracking What Error Messages Payment Status Not Available Means

Stimulus Check Problems Result In Irs Sending Money To Dead People Wrong Accounts During Coronavirus Pandemic Abc11 Raleigh Durham

Qualified Disaster Distributions Vs Stimulus Checks What Are The Differences Marca

Second Coronavirus Relief Package What Does It Mean For You And A Second Stimulus Check The Turbotax Blog

Stimulus Checks Tax Returns 2021

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

The Irs Stopped Accepting Direct Deposit Requests On May 13 That Doesn T Mean You Won T Get A Check However Irs Filing Taxes Deposit

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc11 Raleigh Durham

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Four Reasons Why You May Have To Repay The Irs Due To Stimulus Check Mistakes

Coronavirus Stimulus Checks Sent To Millions Of Dead People Treasury Department Wants Them Back Abc7 San Francisco

Third Stimulus Check Update How To Track 1 400 Payment Status 13newsnow Com

Trouble Getting Your Stimulus Check Here Are Your Options Smartasset